The problems with relying on a single value metric to determine SaaS & service pricing

Value metrics are a cornerstone of software pricing strategies. But what happens when you rely too heavily on a single metric?

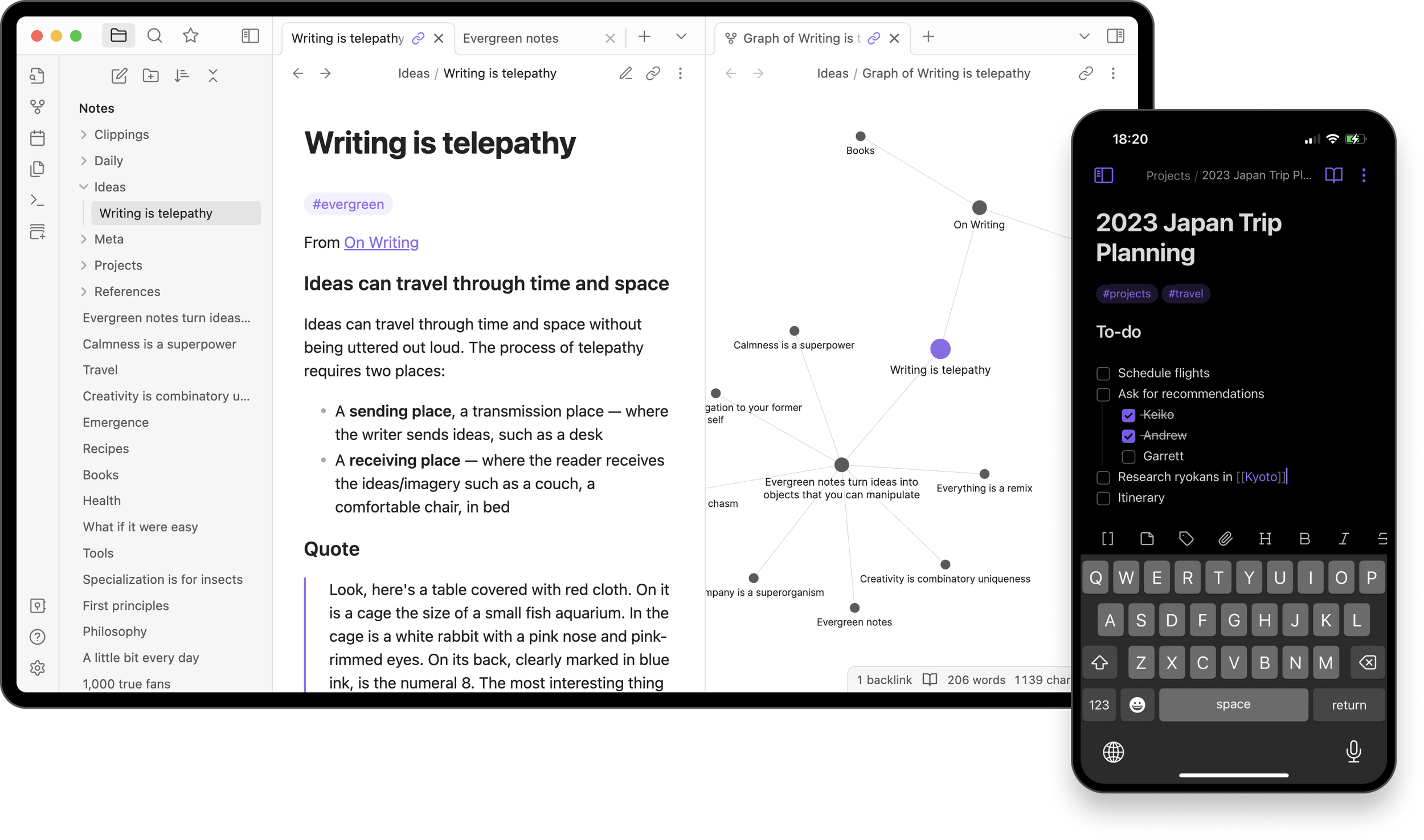

Obsidian as an example of thoughtful pricing strategy and the power of product tradeoffs

OpenAI co-founder, Andrej Karpathy, published a brief “love letter” to the notes app Obsidian, giving his approval to the product and the company’s approach to running a software business.

I agree with everything Karpathy said. Moreover though, Obsidian is a fascinating example of thoughtful pricing & product strategy, and the tradeoffs that follow.

The collision of value-based pricing, customer dysfunction and ROI promises

Just because some companies act in ways which appear — and often are — wasteful, perverse and value-destructive, that doesn’t mean all their employees are blind to the inefficiencies. Ironically, at the heart of effective procurement, are decision makers’ profound understanding of the dysfunction inside their own organisation. It is the dysfunction that will prevent them from realising the full benefits of whatever they’re buying; but awareness of the dysfunction which gives them a truer understanding of the benefits.

When insights aren’t enough: how SaaS & AI companies who are paid to deliver insights get hurt by their own customers’ execution gaps

The old proverb — about leading a horse to water — has a corollary: the horse won’t thank the person who showed them the pond.

This is a problem for companies who provide SaaS & software services which give customers AI-derived insights. If customers don’t act on those insights, then how much value will they place on the source of those insights? How long will it take them to ask why they’re paying so much?

When and what to tell beta customers about B2B SaaS pricing

A B2B founder recently asked how transparent he should be about pricing with early beta users who would initially enjoy free access to his company's proposition.

Other than always trying to avoid nasty surprises, there is no hard-and-fast answer because it will depend on what you’re selling and who you’re selling to. But there are some key points to keep in mind.

The overlooked customer benefit for weakly incentivised users in B2B SaaS and services

When users and decision-makers lack the usual incentives and motivation to hit targets or meet objectives, it can be hard to sell & deploy a product which enables them to do their jobs better.

This post describes why and where this happens, and what B2B SaaS & services vendors can do about it.

The problem with drip-feeding funding to internal startups

Internal startups tend to be drip-fed their funding by the mothership. This reduces the CEO’s agency to operate, has undesirable unintended consequences, and ultimately increases the probability of failure.

Six employee responses to internal startups and corporate innovation

Employees in innovation groups, intrapreneur programs or internal startups are vulnerable to the fact that most other employees (i.e. those with no involvement in the internal startup) will perceive these projects quite differently from their main stakeholders — if they perceive them at all.

These perceptions are important because of the role they can play in determining the internal startup’s success.

In this post, I’ll define six common responses.

Who pays? Understanding fee incidence in online marketplaces and why it matters for pricing

Every marketplace has at least two sides, but it’s not always obvious which side is really paying the fees. The key concept is the burden of the fee does not necessarily fall where the fee is collected.

So, understanding fee incidence is important because, as the marketplace operator, it can affect your approach to pricing, and impact the fundamental operations of your marketplace.

Internal startups and muddled objectives

Why does an internal startup exist? Why would a large company go to the bother & expense of creating an internal startup? There are good answers to those questions. But, this post is about what happens when the answer isn’t clear, or it changes radically depending on who and when you ask.

Founders with one foot in and one foot out

Internal startups often suffer contractual, practical, cultural and emotional ambiguity regarding which company the founding team and employees actually work for. This has so many apparently small details, which then ripple out to a cumulatively big impact.

Why do internal startups often struggle in large corporates? Anti-patterns in corporate innovation groups and internal startups. Part 1.

I’ve seen enough underperforming companies and products that it’s hard to avoid identifying common anti-patterns. But internal startups and corporate innovation groups are a special category. They face structural and organisational challenges — common to corporate innovation — which can be exceptionally difficult to avoid or overcome. First up: how one of the most powerful benefits a corporate could bestow on an internal startup can actually turn into a huge problem.

Applying one multiple to varied revenue streams

Varying risk and volatility associated with different material revenue streams should have a significant effect on the way a startup values itself.